45 us treasury coupon rate

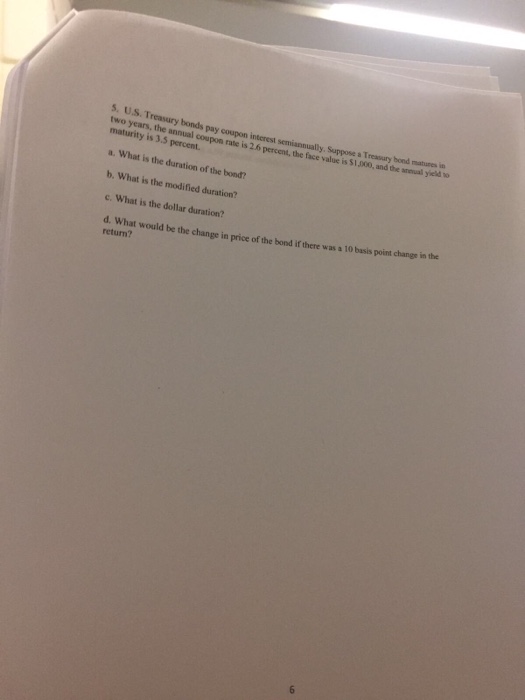

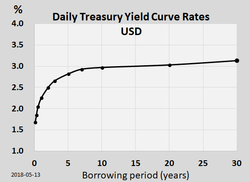

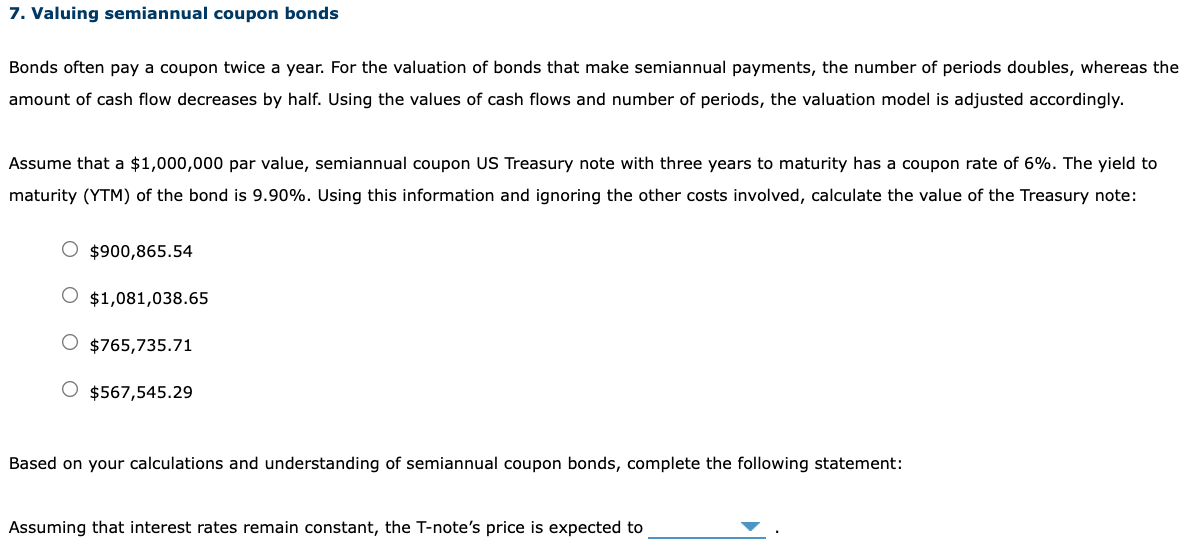

en.wikipedia.org › wiki › United_States_TreasuryUnited States Treasury security - Wikipedia Treasury notes (T-notes) have maturities of 2, 3, 5, 7, or 10 years, have a coupon payment every six months, and are sold in increments of $100. T-note prices are quoted on the secondary market as a percentage of the par value in thirty-seconds of a dollar. Ordinary Treasury notes pay a fixed interest rate that is set at auction. Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

How to Buy US Treasury Bonds (Ameritrade, Fidelity, and more) Dec 22, 2021 · Sticking to our example, let’s say you want to invest in US Treasury Bonds with a maturity rate of 10-12 years. You can try to find an ETF that matches that criteria. ... Par is $100, the face value that US Treasury Bonds sell for. If the coupon rate is higher than the interest rate, they will add a premium. So, if a coupon price is paying 5. ...

Us treasury coupon rate

iShares Treasury Floating Rate Bond ETF | TFLO - BlackRock Nov 17, 2022 · 1. Exposure to U.S. floating rate Treasury bonds, whose interest payments adjust to reflect changes in interest rates 2. Easy access to a new type of Treasury bond (first issued in January 2014) 3. Use to put cash to work, seek stability, and manage interest rate risk home.treasury.govFront page | U.S. Department of the Treasury Treasury Coupon-Issue and Corporate Bond Yield Curve. ... Enhancing the US-UK Sanctions Partnership. ... Treasury Interest Rate Statistics . United States Treasury security - Wikipedia Treasury notes (T-notes) have maturities of 2, 3, 5, 7, or 10 years, have a coupon payment every six months, and are sold in increments of $100. T-note prices are quoted on the secondary market as a percentage of the par value in thirty-seconds of a dollar. Ordinary Treasury notes pay a fixed interest rate that is set at auction.

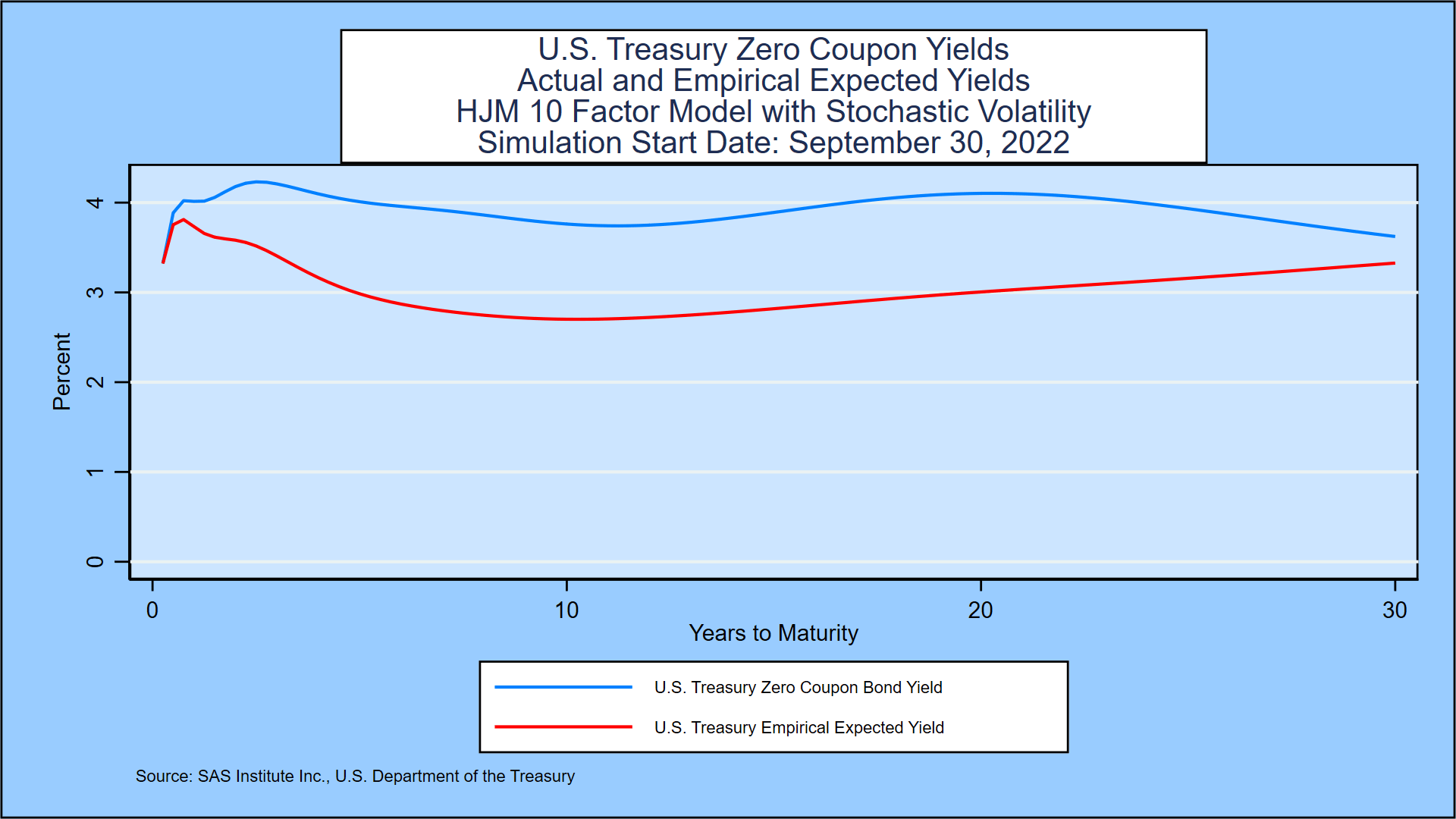

Us treasury coupon rate. Stock Market Data – US Markets, World Markets, After Hours Trading | CNN Stock market data coverage from CNN. View US markets, world markets, after hours trading, quotes, and other important stock market activity. home.treasury.gov › data › treasury-coupon-issuesTreasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ... home.treasury.gov › policy-issues › financialOFAC Recent Actions | U.S. Department of the Treasury Exchange Rate Analysis. ... Treasury Coupon Issues. Corporate Bond Yield Curve. Federal Financial Data. ... Enhancing the US-UK Sanctions Partnership. Front page | U.S. Department of the Treasury Treasury Coupon Issues. Corporate Bond Yield Curve. Federal Financial Data ... Enhancing the US-UK Sanctions Partnership. View all Featured Stories. Press Releases. ... Treasury Long-Term Rates and Extrapolation Factors, and Treasury Real Long-Term Rate Averages. View This Data. Daily Treasury Par Yield Curve CMT Rates. 11/18/2022. 1 Month . 3. ...

OFAC Recent Actions | U.S. Department of the Treasury Interest Rate Statistics. Treasury Securities. Treasury Investor Data. Debt Management Research. Financial Markets, Financial Institutions, and Fiscal Service ... Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. ... Enhancing the US-UK Sanctions Partnership. View all Featured Stories. Press Releases. November 18 ... lifeandmyfinances.com › 2021 › 12How to Buy US Treasury Bonds (Ameritrade, Fidelity, and more) Dec 22, 2021 · If the coupon rate is higher than the interest rate, they will add a premium. So, if a coupon price is paying 5.25% and the interest on the bond is only 1.4%, you’ll pay more per bond than $100. So, if a coupon price is paying 5.25% and the interest on the bond is only 1.4%, you’ll pay more per bond than $100. Military Daily News, Military Headlines | Military.com Daily U.S. military news updates including military gear and equipment, breaking news, international news and more. › us › productsiShares Treasury Floating Rate Bond ETF | TFLO - BlackRock Nov 17, 2022 · 1. Exposure to U.S. floating rate Treasury bonds, whose interest payments adjust to reflect changes in interest rates 2. Easy access to a new type of Treasury bond (first issued in January 2014) 3. Use to put cash to work, seek stability, and manage interest rate risk

Company List - WSJ A comprehensive list of companies available on stock exchanges that can be browsed alphabetically, by sector, or by country. Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury … home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data United States Treasury security - Wikipedia Treasury notes (T-notes) have maturities of 2, 3, 5, 7, or 10 years, have a coupon payment every six months, and are sold in increments of $100. T-note prices are quoted on the secondary market as a percentage of the par value in thirty-seconds of a dollar. Ordinary Treasury notes pay a fixed interest rate that is set at auction.

home.treasury.govFront page | U.S. Department of the Treasury Treasury Coupon-Issue and Corporate Bond Yield Curve. ... Enhancing the US-UK Sanctions Partnership. ... Treasury Interest Rate Statistics .

iShares Treasury Floating Rate Bond ETF | TFLO - BlackRock Nov 17, 2022 · 1. Exposure to U.S. floating rate Treasury bonds, whose interest payments adjust to reflect changes in interest rates 2. Easy access to a new type of Treasury bond (first issued in January 2014) 3. Use to put cash to work, seek stability, and manage interest rate risk

:max_bytes(150000):strip_icc()/shutterstock_164681615-5bfc3a9246e0fb00517ff39b.jpg)

:max_bytes(150000):strip_icc()/terms_b_bond-yield_FINAL-3ab7b1c73e8b487a9e860f0a5ca6dd6b.jpg)

Post a Comment for "45 us treasury coupon rate"