41 zero coupon bond investopedia

Coupon Bond Vs. Zero Coupon Bond: What's the Difference? - Investopedia Web31/08/2020 · A zero-coupon bond does not pay coupons or interest payments like a typical bond does; instead, a zero-coupon holder receives the face value of the bond at maturity. › terms › zZero-Coupon Convertible - Investopedia Apr 11, 2022 · A zero-coupon security is a debt instrument which does not make interest payments. An investor purchases this security at a discount and receives the face value of the bond on the maturity...

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia KEY TAKEAWAYS · Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall. · Zero-coupon ...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Zero coupon bond investopedia

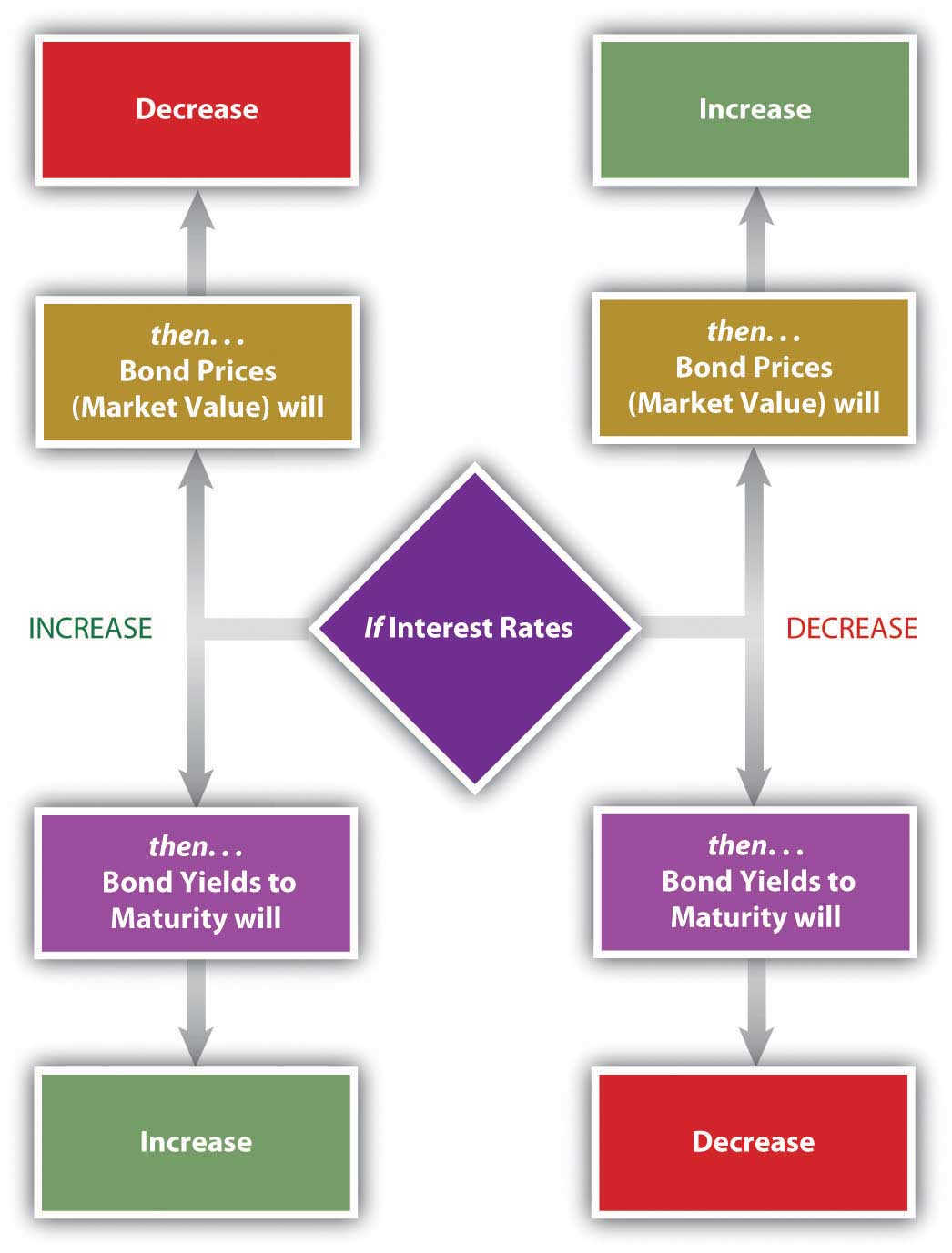

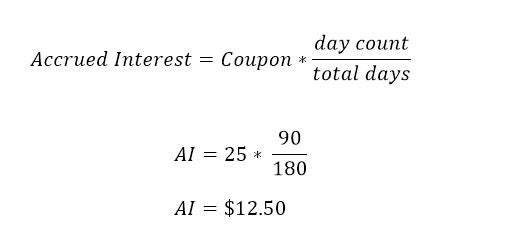

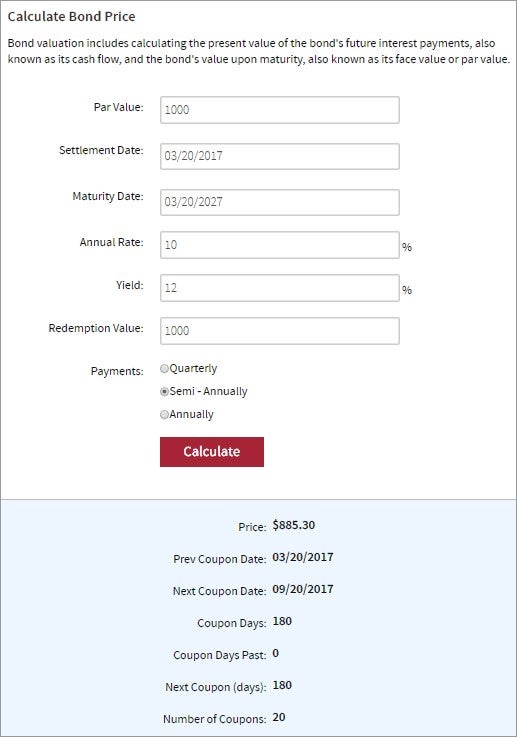

What Is a Bond Coupon, and How Is It Calculated? - Investopedia Web02/04/2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. Zero-Coupon Bond: Definition, How It Works, and How To Calculate A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit ... Understanding Bond Prices and Yields - Investopedia Web28/06/2007 · Bond Prices and Yields: An Overview . If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond.

Zero coupon bond investopedia. › 051215 › what-does-it-mean-if-bond-has-zero-coupon-rateWhat does it mean if a bond has a zero coupon rate? - ... Aug 30, 2022 · A zero coupon bond generally has a reduced market price relative to its par value because the purchaser must maintain ownership of the bond until maturity to turn a profit. A bond that... What Is a Coupon Bond? - Investopedia Web31/03/2020 · Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ... › how-do-i-calculate-yield-maturity-zero-coupon-bondHow to Calculate Yield to Maturity of a Zero-Coupon Bond -... Oct 10, 2022 · Zero-coupon bonds essentially lock the investor into a guaranteed reinvestment rate. This arrangement can be most advantageous when interest rates are high and when placed in tax-advantaged... Coupon Bond: Definition, How They Work, Example, and Use Today A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments.

Zero-Coupon Mortgage Definition - Investopedia Zero-coupon mortgages resemble zero-coupon bonds. The coupon, the annual interest rate paid on the loan, is zero until the expiration date when it must all be ... › terms › zZero-Coupon Swap Definition - Investopedia Sep 11, 2022 · A zero-coupon swap is an exchange of cash flows in which the stream of floating interest-rate payments is made periodically, as it would be in a plain vanilla swap, but where the stream of... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Web31/01/2022 · If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will receive ... What Is a Zero-Coupon Bond? - Investopedia Web31/05/2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

› watchInvestopedia Video: Zero-Coupon Bond - YouTube A debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full face value. The Macaulay Duration of a Zero-Coupon Bond in Excel - Investopedia Web29/08/2022 · The computation of Macaulay duration can be complicated and has a number of variations, but the primary version is calculated by adding up the coupon payment per period, multiplied by the time to ... What does it mean if a bond has a zero coupon rate? - Investopedia Web30/08/2022 · A bond with a coupon rate of zero, therefore, is one that pays no interest. However, this does not mean the bond yields no profit. Instead, a zero coupon bond generates a return at maturity. › introduction-investing › investing-basicsZero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten, fifteen, or more years.

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Web10/10/2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ...

The Basics of Bonds - Investopedia Web31/07/2022 · Bonds are generally priced at a face value (also called par) of $1,000 per bond, but once the bond hits the open market, the asking price can be priced lower than the face value, called a discount ...

corporatefinanceinstitute.com › resources › fixed-incomeZero-Coupon Bond - Definition, How It Works, Formula Oct 26, 2022 · A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and.

Coupon Bond Vs. Zero Coupon Bond: What's the Difference? A zero-coupon bond does not pay coupons or interest payments like a typical bond does; instead, a zero-coupon holder receives the face value of the bond at ...

Understanding Bond Prices and Yields - Investopedia Web28/06/2007 · Bond Prices and Yields: An Overview . If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond.

Zero-Coupon Bond: Definition, How It Works, and How To Calculate A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit ...

What Is a Bond Coupon, and How Is It Calculated? - Investopedia Web02/04/2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

:max_bytes(150000):strip_icc()/recovery-rate.asp_Final-a8fac2c32d704c628b7408edd9604684.png)

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

:max_bytes(150000):strip_icc()/savings-bonds_468446675-5bfc2b55c9e77c0026305ac4.jpg)

:max_bytes(150000):strip_icc()/thinkstockphotos-479586547-5bfc34cf46e0fb00514690c4.jpg)

:max_bytes(150000):strip_icc()/bond-5bfc37fec9e77c00514745d5.jpg)

:max_bytes(150000):strip_icc()/are-bonds-safer-than-stocks-58dc27f03df78c5162810026.jpg)

:max_bytes(150000):strip_icc()/GettyImages-597139701-d3b44a08d65844a89c458a6ed9950100.jpg)

:max_bytes(150000):strip_icc()/GettyImages-183367591-9f457266c3734eb6bb07e4ad05e5f2be.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

:max_bytes(150000):strip_icc()/GettyImages-551987971-41276ca6a78044ab857859bb9f4e0ac1.jpg)

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

:max_bytes(150000):strip_icc()/investing11-5bfc2b90c9e77c00519aa65f.jpg)

Post a Comment for "41 zero coupon bond investopedia"