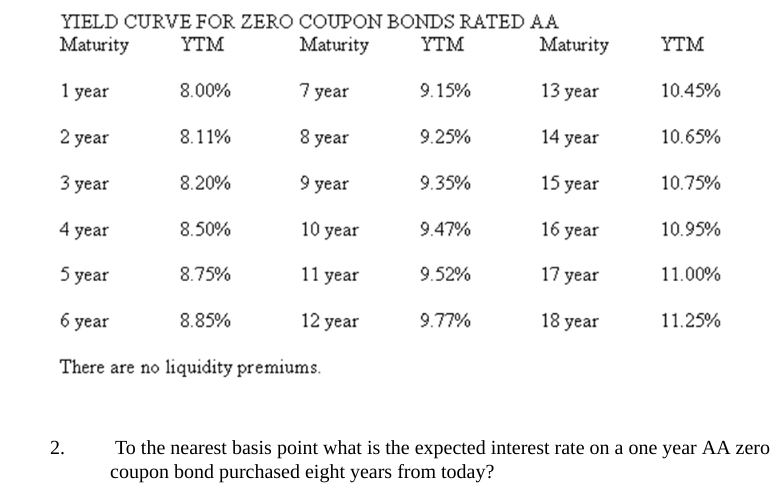

45 yield to maturity for zero coupon bond

What Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Yield curve - Wikipedia The team extended the maturity of European yield curves up to 50 years (for the lira, French franc, Deutsche mark, Danish krone and many other currencies including the ecu). This innovation was a major contribution towards the issuance of long dated zero-coupon bonds and the creation of long dated mortgages.

Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Yield to maturity for zero coupon bond

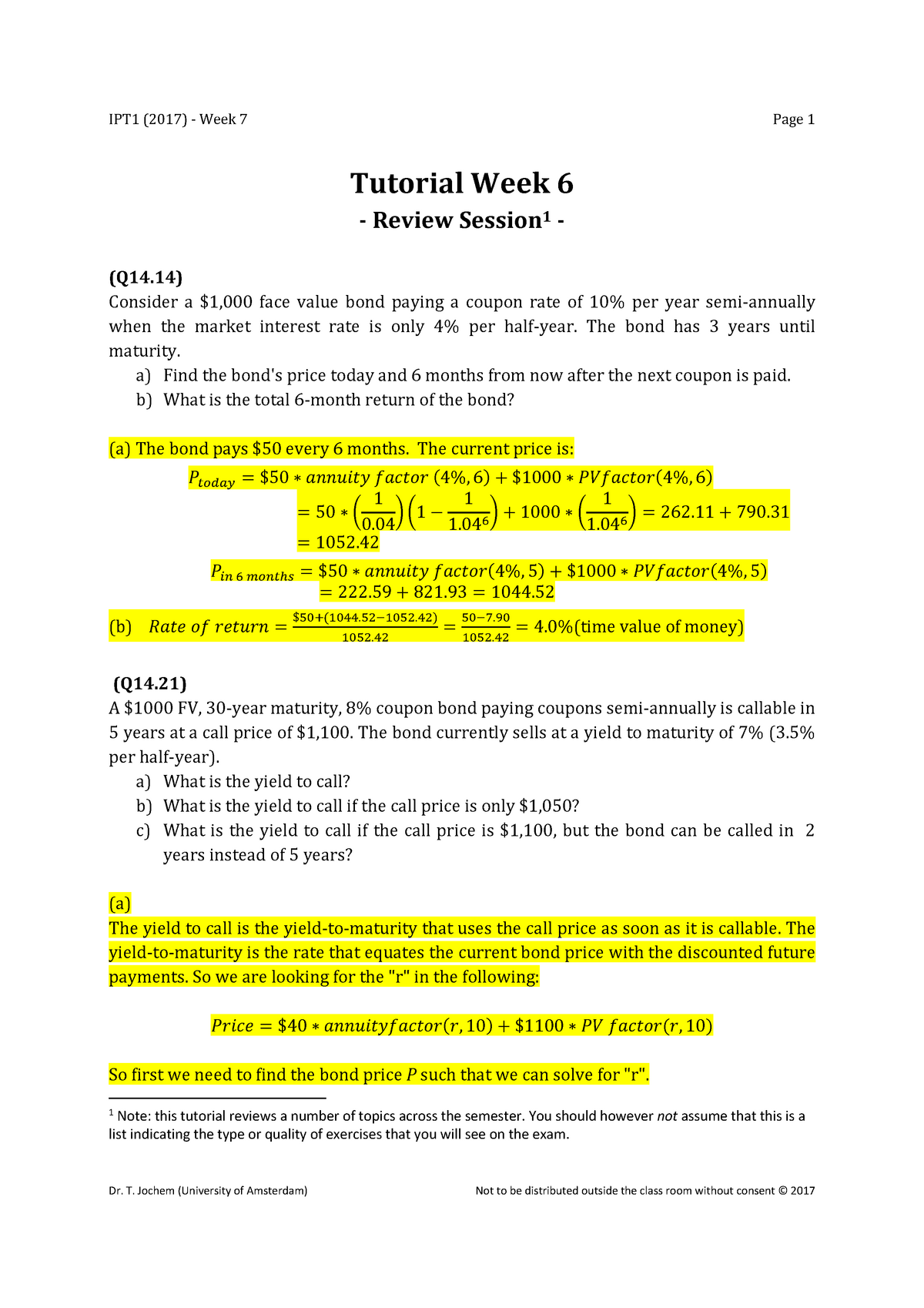

How to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ... Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · At issuance, a bond's yield will equal the coupon rate if the bond was issued at par value. ... How to Calculate Yield to Maturity of a Zero-Coupon Bond. Fixed Income. Yield to maturity - Wikipedia Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105. Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds

Yield to maturity for zero coupon bond. Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... Yield to maturity - Wikipedia Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105. Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · At issuance, a bond's yield will equal the coupon rate if the bond was issued at par value. ... How to Calculate Yield to Maturity of a Zero-Coupon Bond. Fixed Income. How to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ...

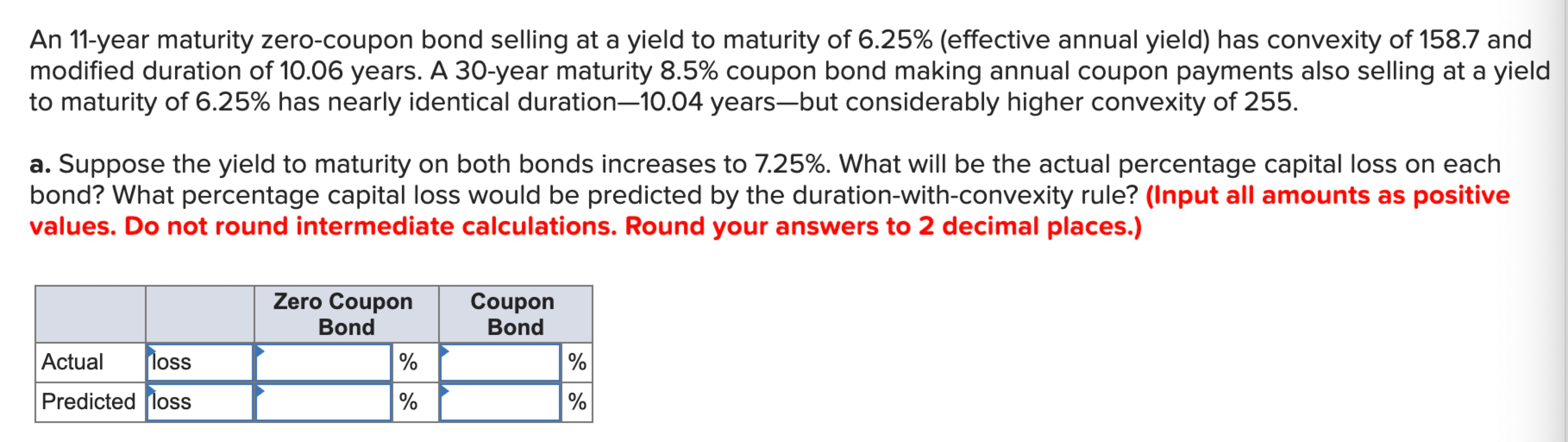

consider a coupon bond that has a 900 par value and a coupon rate of 6 the bond is currently selling

Post a Comment for "45 yield to maturity for zero coupon bond"