42 present value of zero coupon bond calculator

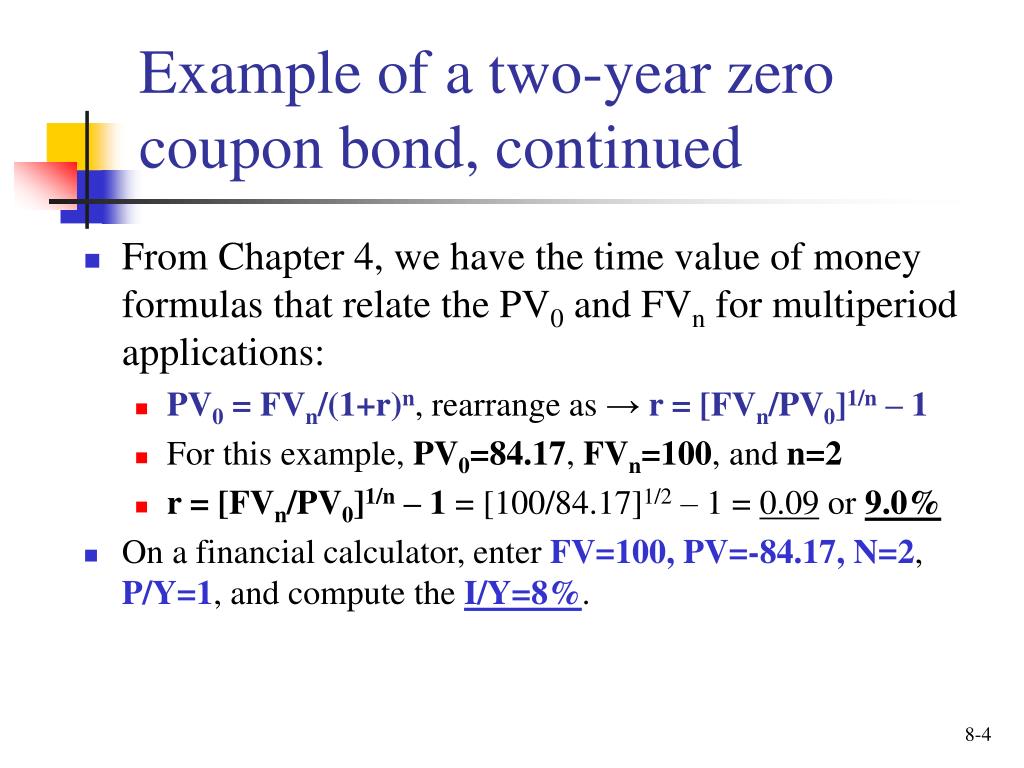

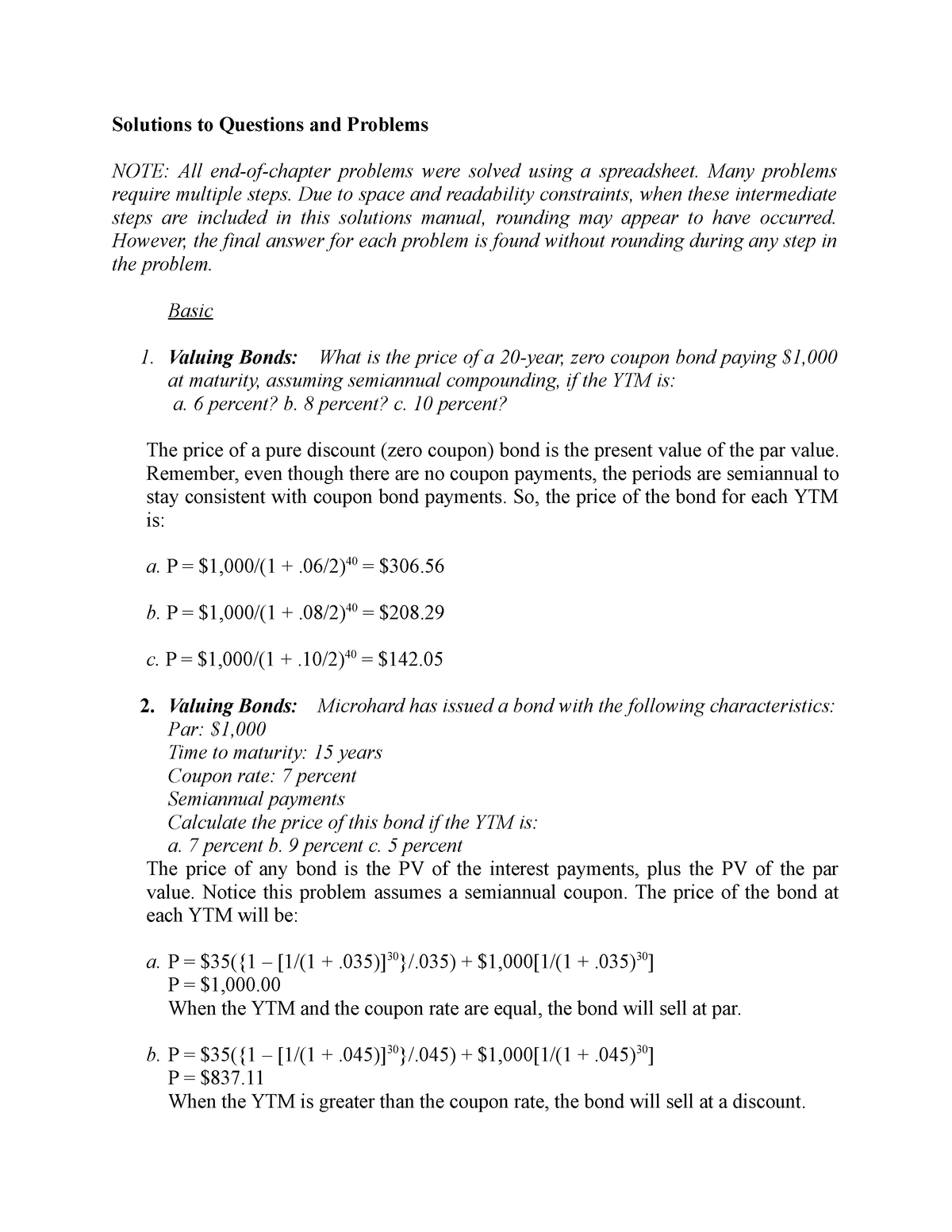

Bond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity. Zero Coupon Bond Calculator – What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator.

Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures. Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value.

Present value of zero coupon bond calculator

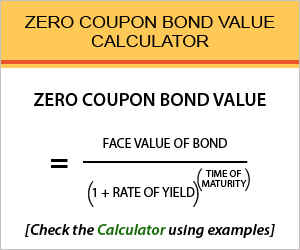

Money: Personal finance news, advice & information - The ... Oct 17, 2022 · Savings rates hit 10-year high as new 4.55pc bond launches 10-year mortgage deals become cheapest on the market Why Jeremy Hunt won’t save Britain from higher mortgage costs Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F , 6% would be r , and t would be 5 years. After solving the equation, the original price or value would be $74.73.

Present value of zero coupon bond calculator. Time value of money - Wikipedia A typical coupon bond is composed of two types of payments: a stream of coupon payments similar to an annuity, and a lump-sum return of capital at the end of the bond's maturity—that is, a future payment. The two formulas can be combined to determine the present value of the bond. Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F , 6% would be r , and t would be 5 years. After solving the equation, the original price or value would be $74.73. Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Money: Personal finance news, advice & information - The ... Oct 17, 2022 · Savings rates hit 10-year high as new 4.55pc bond launches 10-year mortgage deals become cheapest on the market Why Jeremy Hunt won’t save Britain from higher mortgage costs

Post a Comment for "42 present value of zero coupon bond calculator"