43 zero coupon bond yield calculation

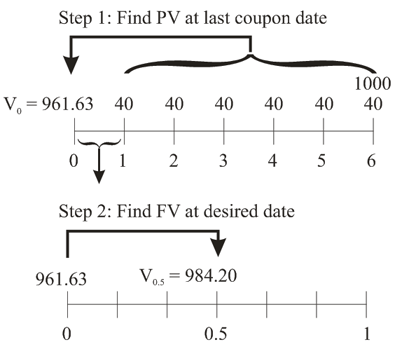

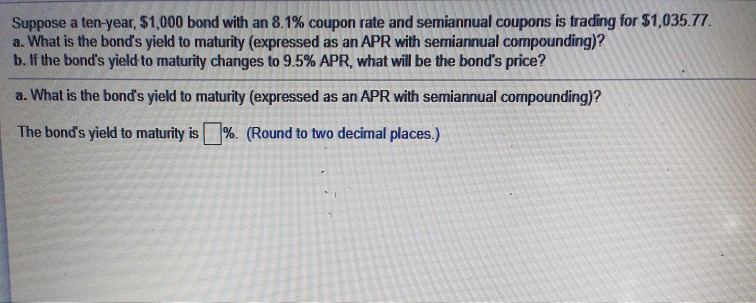

Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years. Microsoft Excel Bond Yield Calculations | TVMCalcs.com We know that the bond carries a coupon rate of 8% per year, and the bond is selling for less than its face value. Therefore, we know that the YTM must be greater than 8% per year. You need to remember that the bond pays interest semiannually, and we entered Nper as the number of semiannual periods (6) and Pmt as the semiannual payment amount (40).

Zero Coupon Yield Curve - The Thai Bond Market Association IRR Calculation; Bond Price. Search by Bond; Month-end MTM Prices; ... Bond Market Data; Yield Curve; Zero Coupon Yield Curve; Service Manager : Wat (0-2257-0357 ext ...

Zero coupon bond yield calculation

Zero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. What Is Bond Yield? - Investopedia May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... Bond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

Zero coupon bond yield calculation. Bond Equivalent Yield (BEY) Definition - Investopedia Mar 24, 2020 · Bond Equivalent Yield - BEY: The bond equivalent yield (BEY) allows fixed-income securities whose payments are not annual to be compared with securities with annual yields. The BEY is a ... Bond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is: What Is Bond Yield? - Investopedia May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... Zero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

:max_bytes(150000):strip_icc()/dotdash_INV_final_Discount_Yield_Jan_2021-01-fc704294a32348a7bc00e0fc7652b88e.jpg)

Post a Comment for "43 zero coupon bond yield calculation"