43 us treasury bonds coupon rate

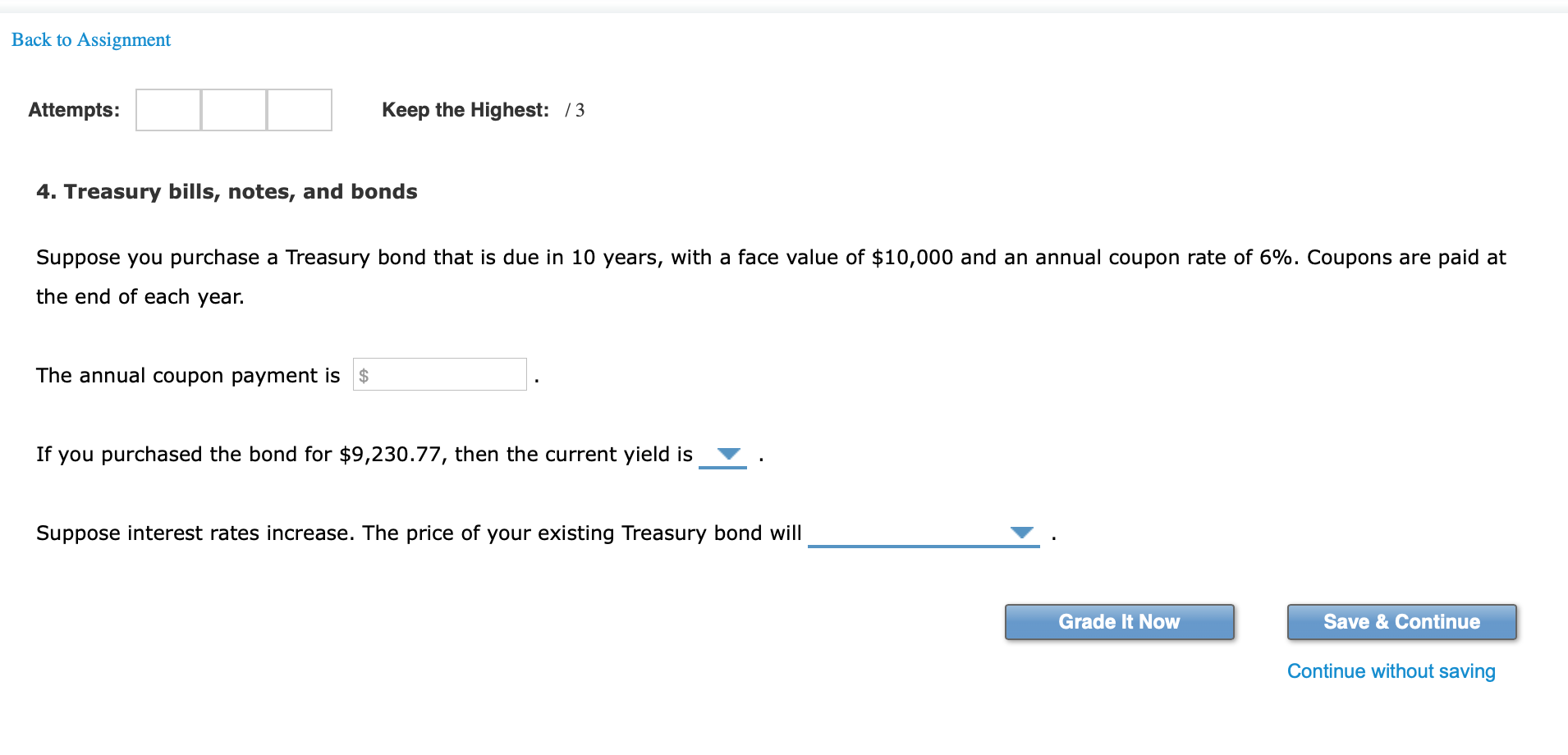

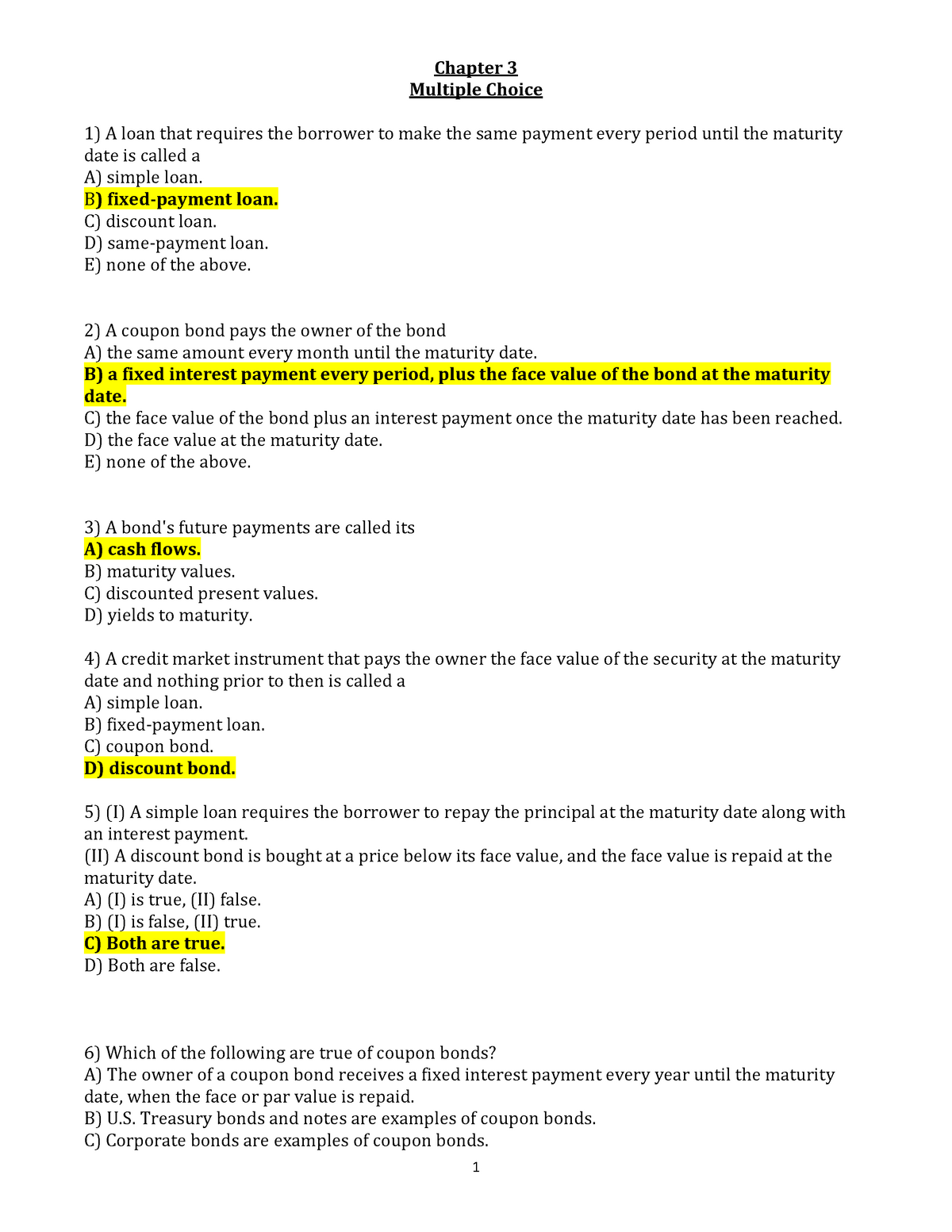

Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers. How Is the Interest Rate on a Treasury Bond Determined? - Investopedia Instead, a set percent of the face value of the bond is paid out at periodic intervals. This is known as the coupon rate. 2 For example, a $10,000 T-bond with a 5% coupon will pay out $500...

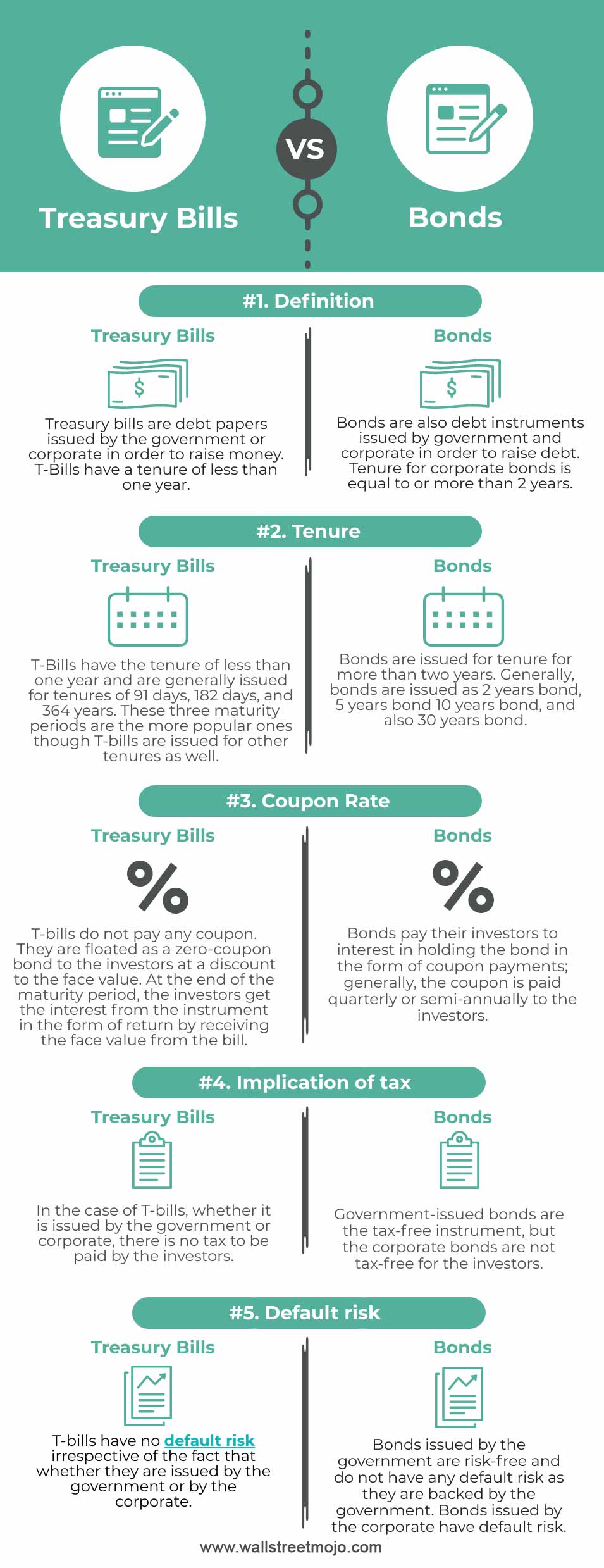

› treasury-bills-vs-bondsTreasury Bills vs Bonds | Top 5 Best Differences (With ... Treasury bills are issued at a discounted price whereas Treasury Bonds pay interest every six months to holders of a bond. Treasury bills mature in a year or less whereas Treasury bonds have a maturity greater than 10 years. Return on investment is low in Treasury bills instruments due to shorter maturity period ahead return on investment is ...

Us treasury bonds coupon rate

Advantages and Risks of Zero Coupon Treasury Bonds 31.1.2022 · Unique Advantages of Zero-Coupon U.S. Treasury Bonds . Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time. Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value)... › us-treasury-bondsUS Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

Us treasury bonds coupon rate. Government - Continued Treasury Zero Coupon Spot Rates* 3.06. 3.20. 3.38. 3.79. *Four quarters covering calendar year 2012 and the first and second quarters of calendar year 2013 prepared by Economic Policy (EP) using the Office of the Comptroller of the Currency (OCC) legacy model. Legacy model quarterly rates can be viewed within the "Selected Asset and Liability Price Report" under "Spot ... Treasury Bills vs Bonds | Top 5 Best Differences (With Infographics) Key Differences between Treasury Bills vs Bonds. Let us Discussed some of the major differences between Treasury Bills vs Bonds: Treasury bills are short term money market instruments whereas Treasury Bonds are long term capital market instruments.; Treasury bills are issued at a discounted price whereas Treasury Bonds pay interest every six months to … ZROZ ETF Report: Ratings, Analysis, Quotes, Holdings | ETF.com Learn everything about PIMCO 25+ Year Zero Coupon US Treasury Index ETF (ZROZ). Free ratings, analyses, holdings, benchmarks, quotes, and news. EOF

United States Rates & Bonds - Bloomberg Get updated data about US Treasuries. Find information on government bonds yields, ... Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year . 0.13: 95.51: home.treasury.govFront page | U.S. Department of the Treasury Treasury Coupon-Issue and Corporate Bond Yield Curve. ... Savings Bonds - Treasury Securities. ... Treasury Interest Rate Statistics . Treasury Bonds vs. Treasury Notes vs. Treasury Bills: What's the ... 29.3.2022 · There are three ways in which to invest in United States debt: Treasury bonds, Treasury notes, and Treasury bills. The length of time when each matures differs, along with how interest is paid on ... United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year

Series I Savings Bonds Rates & Terms: Calculating Interest Rates Series I Savings Bonds Rates & Terms: Calculating Interest Rates. NEWS: The initial interest rate on new Series I savings bonds is 9.62 percent. You can buy I bonds at that rate through October 2022. Learn more.. KEY FACTS: I Bonds can be purchased through October 2022 at the current rate. That rate is applied to the 6 months after the purchase is made. › the-basics-of-bondsThe Basics Of Bonds - Investopedia Jul 31, 2022 · Bonds (T-bonds) issued by the Treasury with a year or less to maturity are called “Bills”; bonds issued with 1 to 10 years to maturity are called “notes”; and bonds issued with more than ... Bonds and Securities | U.S. Department of the Treasury TreasuryDirect.gov website These are just a few of the popular topics found at the TreasuryDirect.gov website: Log on to your TreasuryDirect account Create a new account in TreasuryDirect so you can buy and manage Treasury savings bonds and securities Forms Savings bonds as gifts Death of a savings bond owner Frequently asked questions The … Individual - Treasury Notes: Rates & Terms Treasury Notes: Rates & Terms Notes are issued in terms of 2, 3, 5, 7, and 10 years, and are offered in multiples of $100. Price and Interest The price and interest rate of a Note are determined at auction. The price may be greater than, less than, or equal to the Note's par amount. (See rates in recent auctions .)

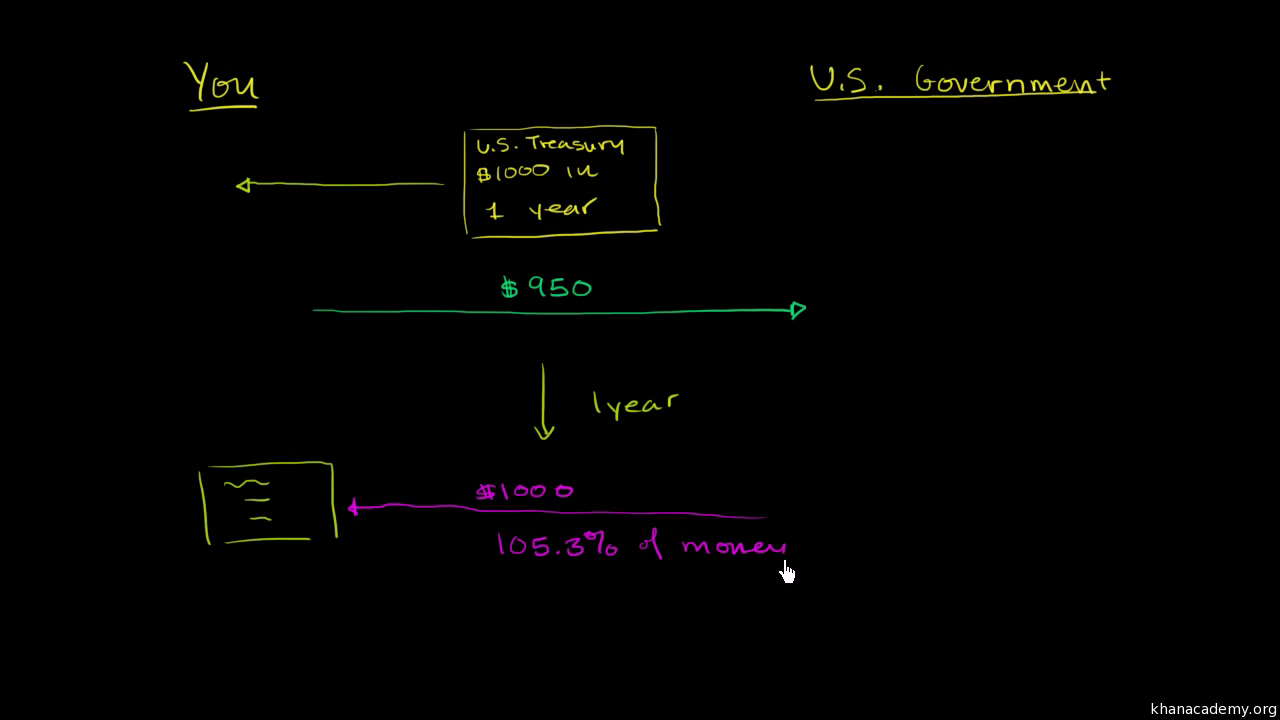

Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

Individual - TIPS: Rates & Terms - TreasuryDirect Follow the link and locate the Index Ratio that corresponds to the interest payment date for your security. Multiply your original principal amount by the Index Ratio. This is your inflation-adjusted principal. Multiply your inflation-adjusted principal by half the stated coupon rate on your security (i.e., 2%).

US Treasury Bonds - Fidelity US Treasury bonds: $1,000: Coupon: 20-year 30-year: Interest paid semi-annually, principal at maturity: Treasury inflation-protected securities (TIPS) ... US Treasury floating rate notes (FRNs) $1,000: Coupon: 2 years: Interest paid quarterly based on discount rates for 13-week treasury bills, principal at maturity:

Bonds Center - Bonds quotes, news, screeners and educational Bonds Center - Learn the basics of bond investing, get current quotes, news, commentary and more. ... US Treasury Bonds Rates. Symbol. Name Last Price Change % Change 52 Week Range Day Chart ^IRX.

Interest Rates - U.S. Department of the Treasury The "Daily Treasury Long-Term Rates" are simply the arithmetic average of the daily closing bid yields on all outstanding fixed coupon bonds (i.e., inflation-indexed bonds are excluded) that are neither due nor callable for at least 10 years as of the date calculated. "The Daily Treasury Par Yield Curve Rates" are specific rates read from the ...

Bonds & Rates - WSJ Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only; comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes.

› quotes › US30YUS30Y: U.S. 30 Year Treasury - Stock Price, Quote and News - CNBC Coupon 3.00%; Maturity 2052-08-15 ... ALL CNBC INVESTING CLUB PRO. Bond yields rise, 2-year Treasury breaks 3.8% on higher Fed hike expectations September 15, 2022 CNBC.com. ... Advertise With Us ...

home.treasury.gov › newsPress Releases | U.S. Department of the Treasury California to Receive up to $1.1 Billion from U.S. Treasury Department to Promote Small Business Growth and Entrepreneurship through the American Rescue Plan September 20, 2022 Readouts READOUT: Secretary of the Treasury Janet L. Yellen’s Meeting with the National Association of Manufacturers’ Board of Directors

Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .)

Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data. View the ...

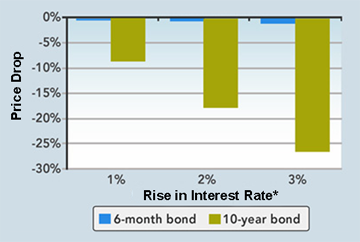

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia The Vanguard Extended Duration Treasury ETF ( EDV) went up more than 55% in 2008 because of Fed interest rate cuts during the financial crisis. 5 The PIMCO 25+ Year Zero Coupon U.S. Treasury Index...

Treasury Coupon Issues | U.S. Department of the Treasury The Yield Curve for Treasury Nominal Coupon Issues (TNC yield curve) is derived from Treasury nominal notes and bonds. The Yield Curve for Treasury Real Coupon Issues (TRC yield curve) is derived from Treasury Inflation-Protected Securities (TIPS). ... TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977 TNC Treasury Yield Curve Spot ...

Individual - Treasury Bonds: Rates & Terms 15.8.2005 · Treasury Bonds: Rates & Terms . Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest. The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions.)

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Some municipal bonds are exempt from income taxes, which boost their equivalent yield when compared against other bonds. Other Treasury Marketable Securities. Investors can also purchase inflation-protected Treasury securites (TIPS), US Treasury floating rate notes (FRN), as well as Treasury Strips.

Individual - Series I Savings Bonds - TreasuryDirect Rates & Terms. I bonds have an annual interest rate derived from a fixed rate and a semiannual inflation rate. Interest, if any, is added to the bond monthly and is paid when you cash the bond. I bonds are sold at face value; i.e., you pay $50 for a $50 bond. More about I bond rates; Redemption Information. Minimum term of ownership: 1 year

Individual - Treasury Bonds TREASURY SECURITIES & PROGRAMS Treasury Bonds Treasury bonds pay a fixed rate of interest every six months until they mature. They are issued in a term of 30 years. You can buy Treasury bonds from us in TreasuryDirect. You also can buy them through a bank or broker. (We no longer sell bonds in Legacy Treasury Direct, which we are phasing out .)

› us-treasury-bondsUS Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value)...

Advantages and Risks of Zero Coupon Treasury Bonds 31.1.2022 · Unique Advantages of Zero-Coupon U.S. Treasury Bonds . Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time.

:max_bytes(150000):strip_icc()/Clipboard01-f94f4011fb31474abff28b8c773cfe69.jpg)

Post a Comment for "43 us treasury bonds coupon rate"