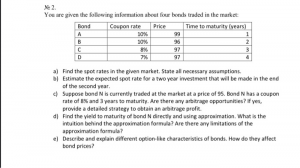

45 relationship between coupon rate and ytm

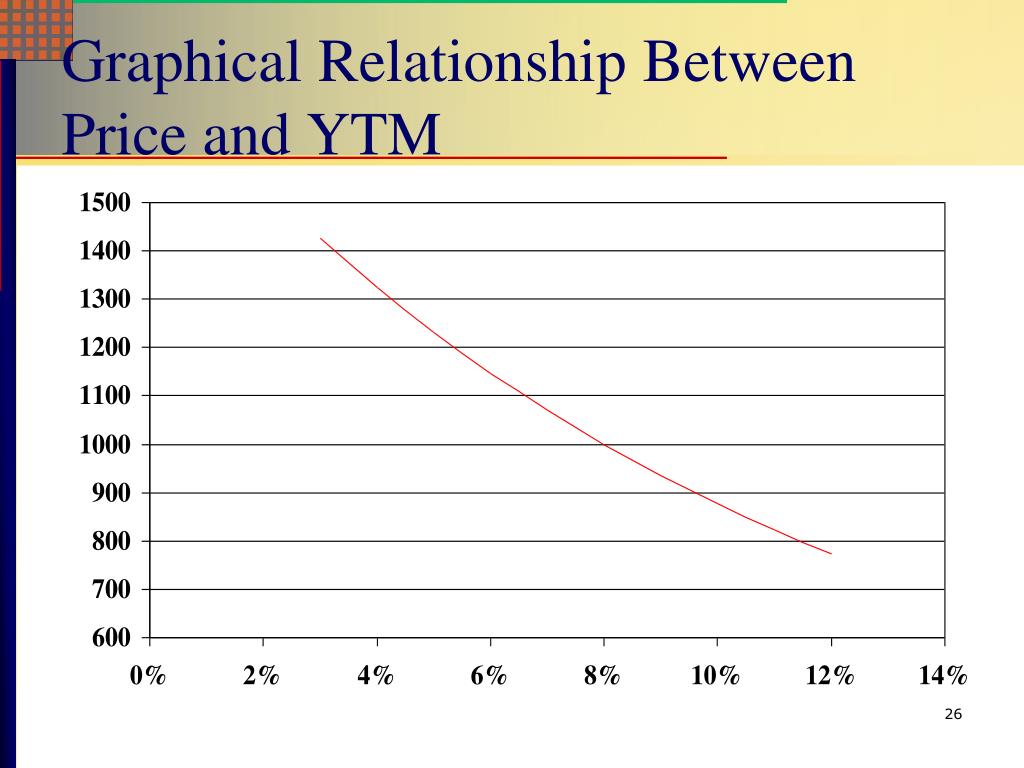

Current Yield vs. Yield to Maturity - Investopedia When a bond's market price is above par, which is known as a premium bond, its current yield and YTM are lower than its coupon rate. Conversely, when a bond sells for less than par, which is known... Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Annual Coupon Rate (%) - The annual interest rate paid on the bond's face value. ... The above graph shows the relationship for price and yield using the default values in the tool. Note the following outputs: Current YtM: Computed current yield to maturity; Current Price: Current bond trading price; X-Axis: Plus and minus 3% changes in market yield; Y-Axis: Estimated price …

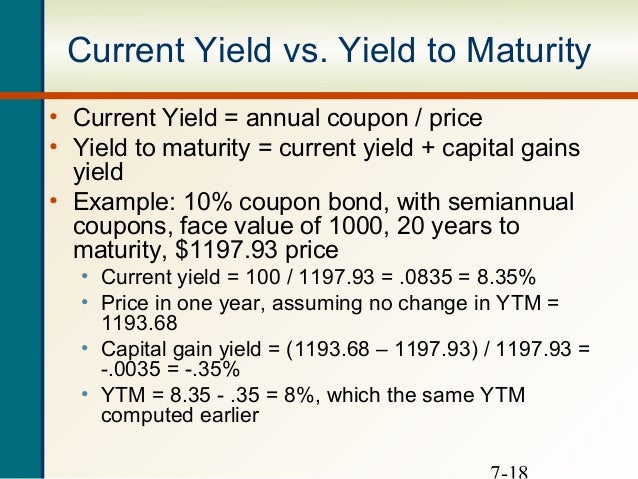

Relationship between Current Yield Yield to Maturity and Coupon Rate ... See Page 1. Relationship between Current Yield, Yield to Maturity and Coupon Rate The relationship between price, nominal yield, current yield and yield to maturity can be seen in Figure 4.5. When a bond sells at par, its current yield = coupon rate = yield to maturity When it sells at a discount, its yield to maturity > current yield > coupon ...

Relationship between coupon rate and ytm

Solved what relationship exists between the coupon interest - Chegg Current value $480 Years to maturity Par value $500 Coupon interest rate 13% a. Calculate the yield to maturity (YTM) for the bond. b. What relationship exists between the coupon interest rate and yield to maturity and the par value and market value of a bond? Explain. b. Relationship Between Coupon and Yield - Assignment Worker Coupon rate = 14%, semiannual coupons YTM = 16% Maturity = 7 years Par value = $1,000 Slide 14 6-14 Example 7.1 • Semiannual coupon = $70 • Semiannual yield = 8% • Periods to maturity = 14 • Bond value = • 70 [1 - 1/ (1.08)14] / .08 + 1000 / (1.08)14 = 917.56 ( ) ( )2t 2t 2 YTM1 F 2 YTM 2 YTM1 1 -1 2 C Value Bond + + + = dqydj.com › bond-convexity-calculatorBond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Annual Coupon Rate (%) - The annual interest rate paid on the bond's face value. Coupon Payment Frequency - How often the bond pays out interest every year. Calculator Outputs. Yield to Maturity (%): The yield you'd recognize holding the bond until maturity (assuming you receive all payments).

Relationship between coupon rate and ytm. Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. 1 It is the sum of all of its remaining coupon payments.... What relationship between a bond's coupon rate and a bond's yield would ... Is YTM the same thing as the coupon rate? Suppose today a 10 percent coupon bond sells at par. Two years from now, the required return on the same bond is 8 percent. YTM is the rate relative to the present value of the bond. It is not the coupon rate which is relatively useless nor does it have anything to do with required rate of return. Coupon Rate Calculator | Bond Coupon 12/01/2022 · As we said above, the coupon rate is the product of the division of the annual coupon payment by the face value of the bond.It merely represents your annual return from your bond investments and does not tell you anything about the actual return of your investments.. On the other hand, the yield to maturity (YTM) represents the internal rate of return of your bond … Current Yield vs. Yield to Maturity - Investopedia 13/12/2021 · Conversely, when a bond sells for less than par, which is known as a discount bond, its current yield and YTM are higher than the coupon rate. Only on occasions when a bond sells for its exact par ...

› terms › aAccreted Value Definition - Investopedia Jul 12, 2021 · Accreted Value: The value, at any given time, of a multi-year instrument that accrues interest but does not pay that interest until maturity. The most well-known applications include zero-coupon ... Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate. How to Calculate Yield to Maturity: 9 Steps (with Pictures) 06/05/2021 · Since this bond is priced at a discount, we know that the yield to maturity will be higher than the coupon rate. Since we know that the coupon rate is 5 percent, we can start by plugging numbers that are higher than that into the formula above to solve for P. Remember, though, you're plugging in an estimated i for semi-annual payments. That ... Yield to Maturity (YTM): Formula and Excel Calculator The relationship between the current YTM and interest rate risk is inversely proportional, which means the higher the YTM, the less sensitive the bond prices are to interest rate changes. Yield to Maturity (YTM) vs Current Yield. The yield to maturity (YTM), as mentioned earlier, is the annualized return on a debt instrument based on the total payments received from the date of …

Relation Between Bond Price and Yield – Risk and Return 04/10/2016 · The relation between bond price and Yield to maturity (YTM) YTM is the total return anticipated on a bond if the bond is held until its lifetime. It is considered as a long-term bond yield but is expressed as an annual rate. Basically, YTM is the internal rate of return of an investment in the bond if the following two conditions are satisfied: Bond Yield Formula | Step by Step Calculation & Examples Suppose a bond has a face value of $1300. And the interest promised to pay (coupon rated) is 6%. Find the bond yield if the bond price is $1600. Face Value = $1300; Coupon Rate = 6%; Bond Price = $1600; Solution: Here we have to understand that this calculation completely depends on annual coupon and bond price. It completely ignores the time ... EOF Yield to Maturity (YTM) Definition - Investopedia 11/11/2021 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , …

Current yield - Wikipedia Relationship between yield to maturity and coupon rate. The concept of current yield is closely related to other bond concepts, including yield to maturity (YTM), and coupon yield. When a coupon-bearing bond sells at; a discount: YTM > current yield > coupon yield; a premium: coupon yield > current yield > YTM

The Relationship Between a Bond's Price & Yield to Maturity That's because your yield to maturity at the time you buy the bond is based on receiving the full maturity value of the bond, typically $1,000. If you sell a bond before it comes due, you'll receive whatever the current market value is for your bond, which may be more or less than you paid. As a result, your yield to maturity will vary.

Difference Between Coupon Rate and Yield of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

Relation Between Bond Price and Yield - Risk and Return However, your yield, in that case, becomes ( 8/90 * 100 = 8.89%, which is more than the coupon rate.) On the other hand, in case you buy the debt instrument at Rs. 110/-, the current yield will be less than the coupon rate ( 8/110 * 100 = 7.27%) Note here that you will not buy the instrument always at the face value.

Chapter 10 concept questions Flashcards & Practice Test - Quizlet For bonds selling at par value? a. Bond price is the present value term when valuing the cash flows from a bond; YTM is the interest rate used in valuing the cash flows from a bond. They have an inverse relationship. b. If the coupon rate is higher than the required return on a bond, the bond will sell at a premium, since it provides periodic ...

How to calculate Spot Rates, Forward Rates & YTM in EXCEL 31/01/2012 · 3 mins read a. How to determine Forward Rates from Spot Rates. The relationship between spot and forward rates is given by the following equation: f t-1, 1 =(1+s t) t ÷ (1+s t-1) t-1-1. Where. s t is the t-period spot rate. f t-1,t is the forward rate applicable for the period (t-1,t). If the 1-year spot rate is 11.67% and the 2-year spot rate is 12% then the forward rate applicable …

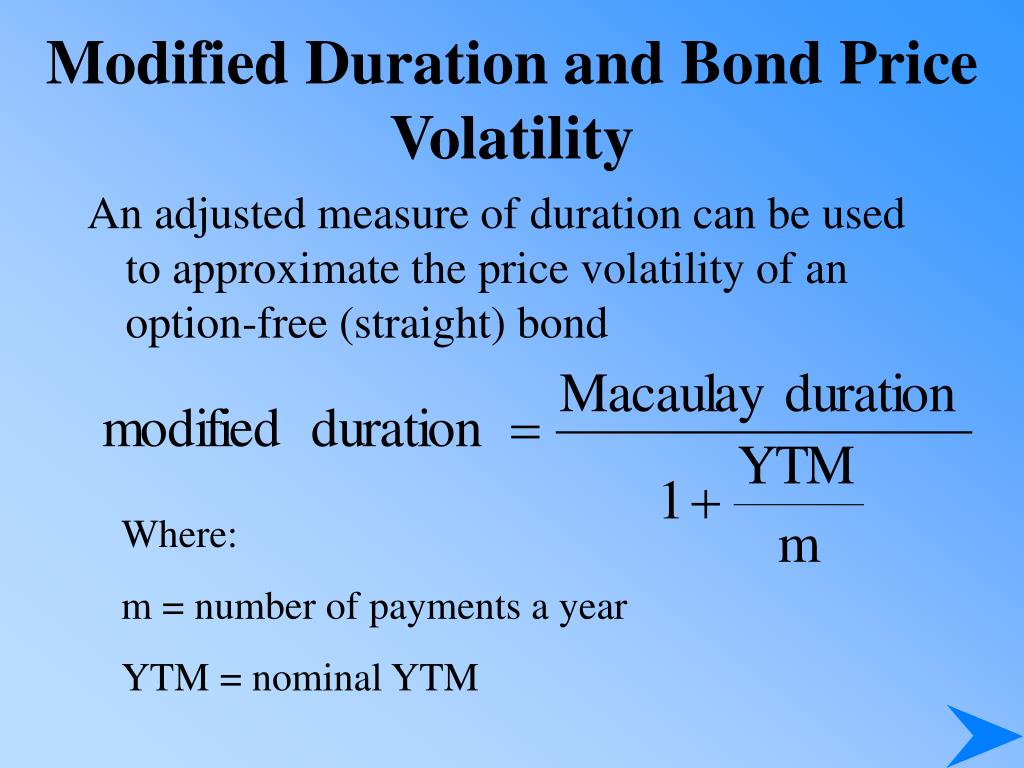

THE RELATIONSHIP BETWEEN YIELD DURATION AND MATURITY - Bond Math - Ebrary FIGURE 6.1 Relationships between Macaulay Duration and Maturity. It's true - given the same coupon rate and yield, the 20-year bond actually does have the higher percentage price increase for the same drop in yield, 5.85% compared to 5.46%. Try to explain this without appealing to duration. I have tried to do so but cannot.

Important Differences Between Coupon and Yield to Maturity Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

What is the relation between the coupon rate on a bond and its duration ... Click to see full answer. Simply so, what is the relationship between the price of a bond and its YTM? A bond's yield to maturity (YTM) is the internal rate of return required for the present value of all the future cash flows of the bond (face value and coupon payments) to equal the current bond price.YTM assumes that all coupon payments are reinvested at a yield equal to the YTM and that the ...

Returns, Spreads, and Yields | AnalystPrep - FRM Part 1 Study Notes If the coupon rate < YTM, the bond will sell for less than par value, or at a discount. If coupon rate= YTM, the bond will sell for par value. Over time, the price of premium bonds will gradually fall until they trade at par value at maturity. Similarly, the price of discount bonds will gradually rise to par value as maturity gets closer.

Relationship Between Coupon Rate And Ytm - May 2022 Verified ... Relationship Between Coupon Interest Rate And Ytm, einstein bagels printable coupons september 2019, printable sunday newspaper coupons online, deals on flights to tampa florida ... Login with Relationship Between Coupon Interest Rate And Ytm your existing account. Create a new account. Remember Me Flour (1) $899.99 $1169.99. limit 4 like ...

dqydj.com › bond-convexity-calculatorBond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Annual Coupon Rate (%) - The annual interest rate paid on the bond's face value. Coupon Payment Frequency - How often the bond pays out interest every year. Calculator Outputs. Yield to Maturity (%): The yield you'd recognize holding the bond until maturity (assuming you receive all payments).

Relationship Between Coupon and Yield - Assignment Worker Coupon rate = 14%, semiannual coupons YTM = 16% Maturity = 7 years Par value = $1,000 Slide 14 6-14 Example 7.1 • Semiannual coupon = $70 • Semiannual yield = 8% • Periods to maturity = 14 • Bond value = • 70 [1 - 1/ (1.08)14] / .08 + 1000 / (1.08)14 = 917.56 ( ) ( )2t 2t 2 YTM1 F 2 YTM 2 YTM1 1 -1 2 C Value Bond + + + =

Solved what relationship exists between the coupon interest - Chegg Current value $480 Years to maturity Par value $500 Coupon interest rate 13% a. Calculate the yield to maturity (YTM) for the bond. b. What relationship exists between the coupon interest rate and yield to maturity and the par value and market value of a bond? Explain. b.

:max_bytes(150000):strip_icc()/BareYTMFormula-5d34698cfb7141d994781ca0fd54e332.jpg)

Post a Comment for "45 relationship between coupon rate and ytm"